Latest News & Events

Welcome to the Concord FCU newsroom.

Please check back often for the latest news, events, promotions, and more!

Dr. Martin Luther King, Jr.

This year, as we celebrate the birth and sacrifice of Dr. Martin Luther King, Jr. let us also remember his work, courage, contribution to social justice and non-violence and his amazing legacy...

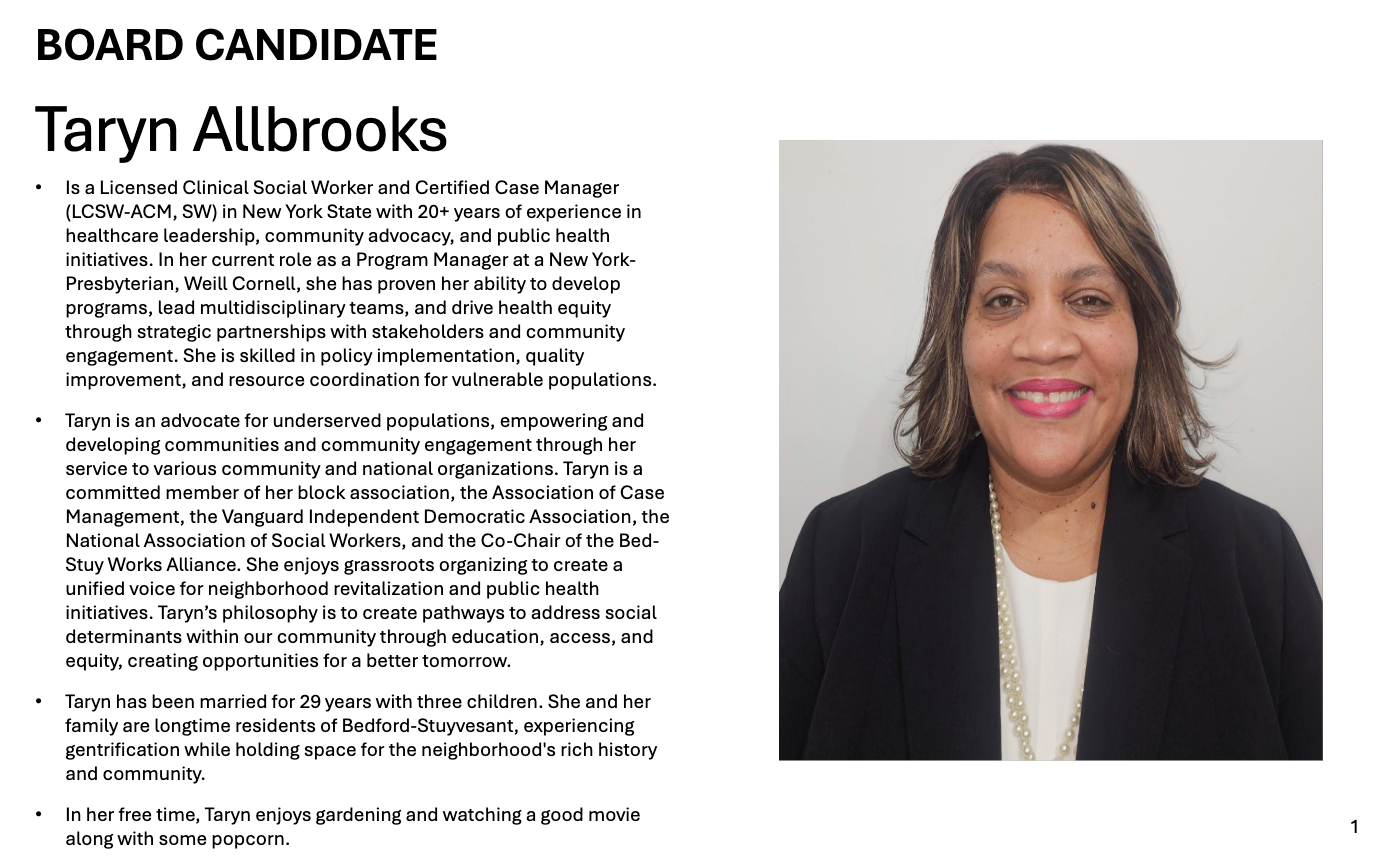

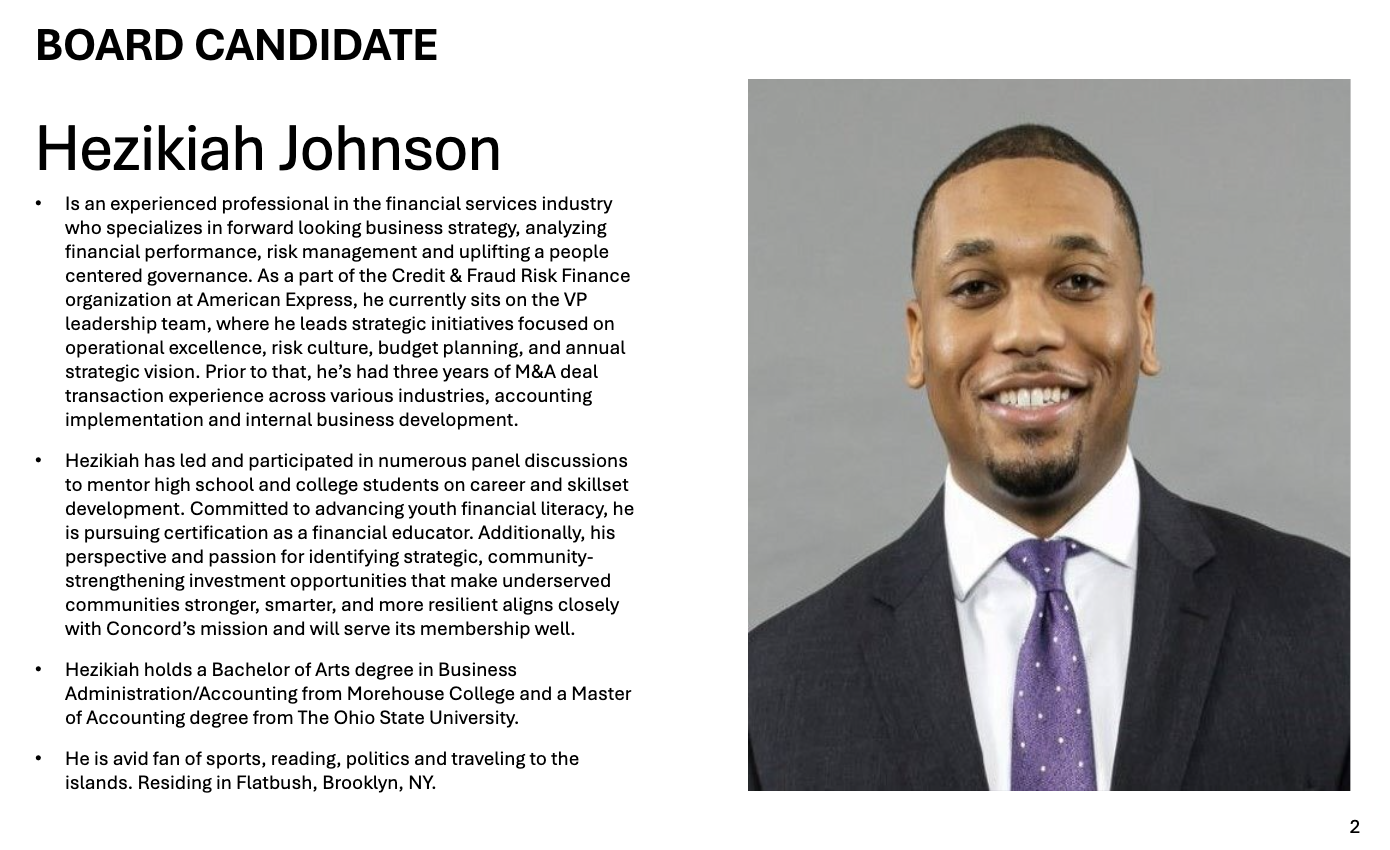

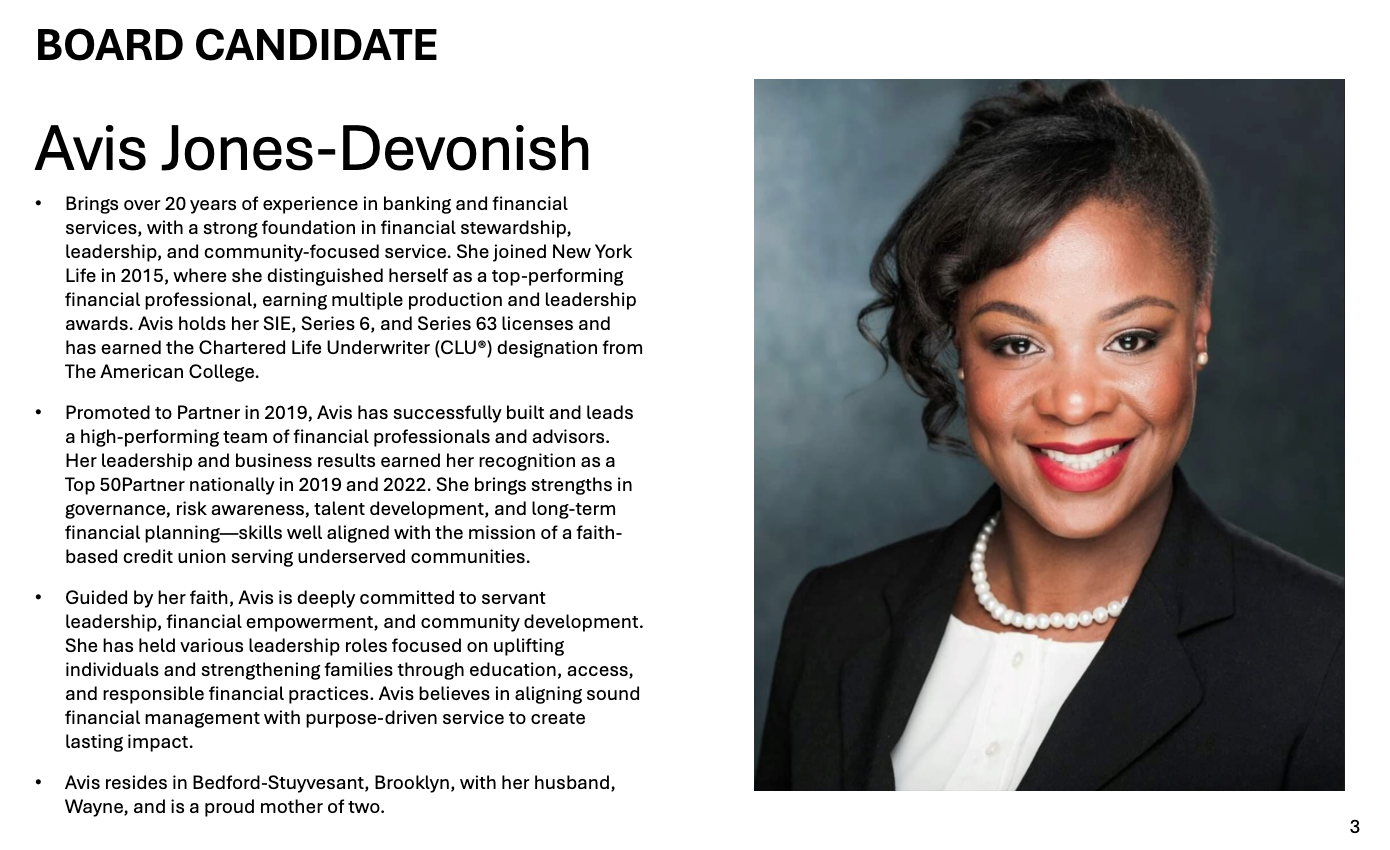

Board Candidates

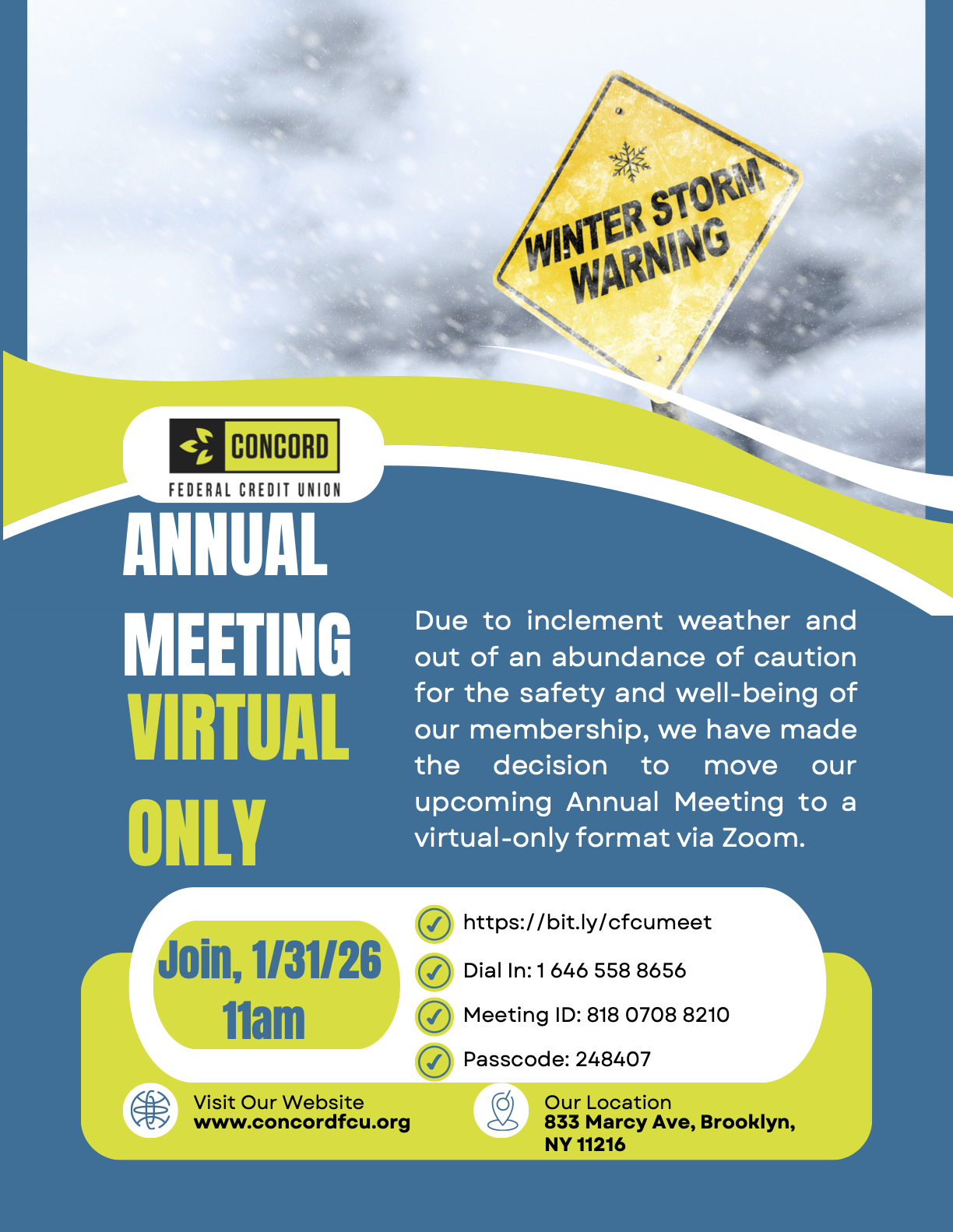

Annual Meeting January 31, 2026

INTRODUCING THE VACATION SAVINGS CLUB

Concord Federal Credit Union is pleased to announce the launch of the Vacation Savings Club account-- the newest addition to the credit union’s product offering.

Message from the Chair of Concord Federal Credit Union, Deborah Boatright

November 29 is Small Business Saturday — and here at Concord Federal Credit Union, we know that when our small businesses thrive, our entire community rises with them.

As a legacy credit union rooted in historic Bedford-Stuyvesant, Concord has spent decades championing economic empowerment, financial access, and local ownership. Supporting our neighborhood businesses is one powerful way to strengthen Bed-Stuy — and supporting your credit union is another.

This Small Business Saturday, we invite you not only to shop local, but also to invest in the institutions that invest in you:

• Encourage a friend or family member to open an account.

Growing our membership strengthens our cooperative model and expands our ability to serve more residents and entrepreneurs.

• Take advantage of Concord’s low-cost loan products.

Every personal loan, auto loan, or small business loan you take with Concord keeps dollars circulating inside our community and helps us offer even more affordable financial services.

• Use Concord for your everyday banking needs.

When you choose your community credit union, you are directly supporting local economic development — not a commercial corporation.

Your support really matters. Every new member, every loan, every saved dollar helps Concord build a stronger, more financially empowered Bedford-Stuyvesant.

This November 29, let’s celebrate Small Business Saturday by keeping our dollars local, supporting neighborhood entrepreneurs, and strengthening the credit union that has served this community for generations.

Together, we keep Bed-Stuy strong.

Deborah Boatright, Chair

Concord Federal Credit Union Board of Directors

Holiday CLUB. Start saving today!

The holidays are right around the corner. Is your 2025 budget ready for holiday gifting? If not, then now is the time to plan for 2026 by opening a Holiday club account and start saving! It’s quick and easy. Accounts can be opened with a $10 minimum deposit. Contribute regularly (bi-weekly, monthly, quarterly) through automatic deposits and enjoy the holidays without incurring debt. Dividends earned at the current rate and paid quarterly in November. For more information, call us at 718-622-0623.

Open a Holiday club account today!

Message from the Chair of Concord Federal Credit Union, Deborah Boatright

International Credit Union Day 2025

As we join credit unions around the world in celebrating International Credit Union Day, we honor the spirit of cooperation, community, and empowerment that defines the credit union movement.

Concord Federal Credit Union was founded almost 75 years ago, when mainstream banks were not lending to minorities. CFCU’s mission was to create access to fair, affordable financial services and opportunities to strengthen the members, their families, and the Bed-Stuy community at large.

Our mission continues to be rooted in people helping people. It’s a principle that guides us as we strive to maintain and grow during these difficult times, and advocate for financial inclusion of our members, small businesses and the under-resourced residents in the communities we serve.

On behalf of the CFCU Board of Directors, I extend heartfelt thanks to our dedicated staff, volunteers, and loyal members. Together, we are more than a credit union—we are a powerful force for economic equity and community progress.

Happy International Credit Union Day!

Deborah Boatright, Chair

Concord Federal Credit Union Board of Directors

7 Passive Income Ideas to Earn Extra Money (Nerd Wallet)

Consulting, Freelance work

Tutoring

Babysitting

Pet sitting, dog walking

Grocery delivery services

Driving services (Uber, Lyft)

Online testing, surveys

50/15/5 Rule, A Simple Guide for Savings & Spending (Fidelity)

Allocate 50% of take home pay to essential expenses (Rent, food, utilities, health insurance)

Save/automate 15% of pre-tax income for retirement (401K, IRA)

Stash 5% of take home pay for unplanned expenses (Emergency fund)

Final Thoughts...

Research shows that by sticking with the 50/15/5 Rule lays the foundation for managing your money and by doing so there's a good chance of maintaining financial stability now and potentially for the long term to retirement.

6 Ways to Help Your Money Work for You (SOFI)

Identify your most important financial goal

Set a goal to keep finances in order

Learn how to budget & stick to it

Pay off high interest debt

Open a High Yield savings account

Automate bill payments

Message from the Chair of Concord Federal Credit Union, Deborah Boatright

A CALL TO ACTION: REIGNITE, REBUILD, RECLAIM OUR FUTURE!

Dear Members,

Welcome! During this, our 73rd Annual Meeting, we reflect on the vibrant spirit of Bedford-Stuyvesant and the enduring legacy of Concord Federal Credit Union. Since our founding in 1951, we have stood with determination, empowering African American families to overcome systemic barriers and a wealth gap to achieve economic prosperity. At the heart of our success lies you, our members. We are a cooperative, member-owned, and you are the lifeblood that sustains our work. Your support fuels our mission and our values of resilience, empowerment, and economic justice.

Now is the time to reignite Concord for future generations. Your continued support is not only an investment in our collective financial future but a testament to our strength. Let us fortify the foundation the founders of CFCU laid. We are small but mighty.

Here’s how YOU can help secure the future of CFCU and our community:

1. Grow Our Membership: Invite your family, friends, and neighbors to join CFCU. Membership is the cornerstone of CFCU. Every new member enhances our ability to serve and uplift.

2. Borrow with Purpose: Whether you’re planning to start or expand a business, repair your home or cover personal needs, choose CFCU as your financial partner. Every loan supports CFCU’s growth and reinvests in our community.

3. Invest in Our Financial Community: Open a savings account, increase your deposits, or start a Christmas Club. Every dollar placed with CFCU strengthens our financial stability and is a pledge to our shared future.

4. Volunteer Your Time and Expertise: Our strength lies in the collective wisdom and skills of our members. Whether it’s financial experience, organizational skills, or a passion for community outreach, we need your hands and heart to help us succeed.

5. Stay Informed and Spread the Word: Use our online and mobile platforms to manage your finances with ease. Visit our website and stay updated on news. Become a CFCU ambassador and share our story and the critical need for community support.

This year’s Annual Meeting is more than an event – it’s a rallying cry. Join us as we recommit to our shared vision, celebrate our achievements, and chart a bold course for the future. Let’s prove, once again, that we are stronger together. Take action. Call us at (718) 622-0623.

Sincerely,

Deborah Boatright, Chair

Concord Federal Credit Union Board of Directors

How To Avoid Credit Union/Bank Fees (American Bankers Association)

Sign up for direct deposit

Maintain the minimum balance

Automate regular deposits (weekly, monthly, quarterly)

Keep track of transactions & account balances

Set up overdraft alerts

Sign up for account notifications (email, text)

Message from the Chair of Concord Federal Credit Union

Bridging Legacies: Concord Federal Credit Union’s Commitment to Equality

Dear Concord Federal Credit Union Members,

I am honored to address you as the newly elected Chair of the CFCU Board of Directors. My name is Deborah Boatright, and it is with great enthusiasm and a deep sense of responsibility that I take on this role to lead our credit union forward.

As we embark on a new year, I find it fitting to reflect on our roots and the profound connection between our history and the spirit of Black History Month. Concord Federal Credit Union, established in 1951, emerged in response to a pressing need within our community – a need rooted in social injustice and prejudice.

In those early years, redlining by mainstream banks denied Black individuals the essential mortgages and loans required to build stable homes and prosperous lives. Concord Federal Credit Union, standing on the shoulders of its ancestors, was founded to challenge this discriminatory practice. Our credit union became a beacon of hope, offering financial support to those facing the challenges of starting anew in unfamiliar cities.

As we celebrate Black History Month, let us honor the resilience of those who paved the way for our credit union. Their vision and dedication continue to inspire us as we strive to close the racial wealth gap and provide opportunities for all members of our community.

In the coming months, I look forward to working together to uphold our founding principles and ensure that Concord Federal Credit Union remains a pillar of support and empowerment for everyone we serve.

Thank you for the trust you have in our credit union, and I am excited about the journey ahead.

Sincerely,

Deborah Boatright, Chair

Concord Federal Credit Union Board of Directors

Email Receipts are Here!

When you visit us or mail in a transaction, just let us know that you'd like your receipt emailed to you. We encourage you to receive your receipt by email. It's fast, secure and cuts down on costs.

ONLINE BANKING HAS A FRESH NEW LOOK

Concord Federal Credit Union’s Online Banking has a fresh new look!

The features remain the same, but the redesign has made the site more colorful and easy to use.

Current Online Banking users, log in using the same credentials you have already created. For new users, please register first.

PRIVACY POLICY

Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do.

New Fee Schedule Effective November 1, 2025

The following fees may be assessed against your Concord Federal Credit Union account and the following transaction limitations, if any, apply to your account.

CONTACT US

833 Marcy Ave, Brooklyn, NY, 11216

718-622-0623

Hello@ConcordFCU.org

HOURS

Tuesdays, Wednesdays, and Thursdays

11:00 am to 2:00 pm or call for an appointment

CFCU Routing Number #226074302